Offsetting Rising Healthcare Costs

January 31, 2025

Offsetting Rising Healthcare Costs

Understanding how an HRA, FSA or HSA can work for your organization.

When it comes to health care costs, it seems the only way is up. Over the last two decades, costs have continued to rise sharply in the United States with no signs of slowing down. This rise is putting more pressure on employers who not only have to reign in increasing health care costs and keep employee coverage affordable, but also remain attractive to current and prospective talent despite their shrinking budgets. According to the Centers for Medicare and Medicaid Services (CMS), the U.S. spent $4.5 trillion on health care in 2022, and costs are projected to reach $6.2 trillion, or 19.7% of GDP, by the year 2028. So, what can employers do to meet the challenge of rising medical expenses, remain attractive to talent prospects and keep their organizational costs low?

HRA vs. HSA vs. FSA: Understanding the Differences

Health Reimbursement Arrangements (HRAs), Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs) are valuable tools for employers looking to manage rising healthcare costs while making their overall benefits package more appealing to current employees and talent prospects. All three benefits work to offset eligible medical expenses in a tax-free way for both the employer and the employee. Despite their similarities, there are key differences when you look more closely at the details.

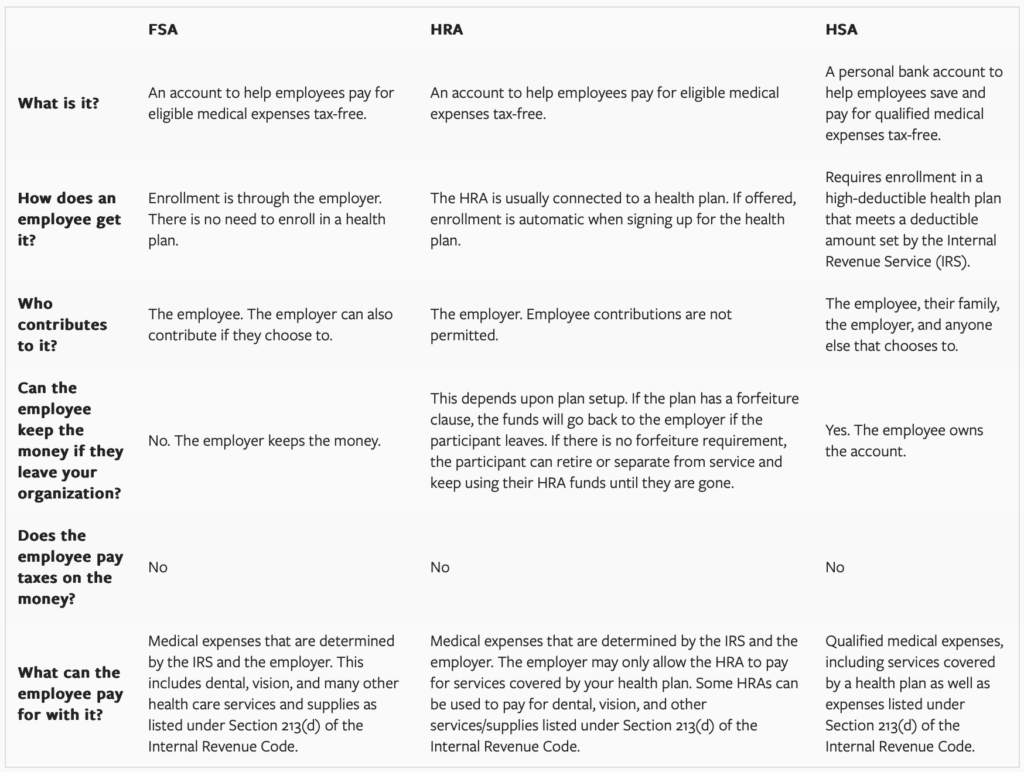

Below is a comparison chart to help you understand the differences between HRAs, HSAs, and FSAs—and which option could work best for your organization and your employees:

There are many similarities between the three types of plans, but there are also some distinct differences, particularly in expense eligibility, participation eligibility, design flexibility, and what becomes of unused funds. While HRAs permit reimbursement for health insurance premiums, HSAs and FSAs generally do not. FSAs and HRAs are open to all participants and retirees, but HSAs must meet certain IRS-defined eligibility requirements—in addition to enrollment in a high-deductible health plan. And finally, unused FSA funds, and unused funds in HRAs that have a forfeiture clause, will revert to the employer, but HSA funds are completely portable, meaning the employer cannot benefit from unused funds if an employee leaves the company.

While health insurance premiums will continue to rise, employers have options to potentially reduce escalating costs while still providing a valuable benefit to their employees and encouraging employees to become more invested in their own health care.