RETIREMENT SOLUTIONS

401(a) Retirement Plans

Retirement savings for public and non-profit employees.

401(a) plans, like 403(b) plans, are found in the public and non-profit sector, helping employees save for retirement and take advantage of tax savings. Public and non-profit sector employers may offer or sponsor both types of plans.

Compared to 403(b) plans, 401(a) plans:

- Provide more control over who is eligible to contribute and how much they should be contributing.

- Generally make it mandatory for eligible employees to enroll in the 401(a) plan.

- Have stricter models for the plan sponsor to contribute — employer contributions are mandatory

- Don’t allow for catch-up contributions for older or long-tenured employees

- Traditionally offer safer, less comprehensive investment options

Which plan is right for your public sector or non-profit sector employees?

It depends. Your talent recruitment and retention challenges, your financial goals and risk tolerance all play a factor. Let us help you make it simple and demonstrate how retirement plans can be combined with other employee benefit solutions to meet your needs, today and tomorrow.

Our 401(a) plan features include:

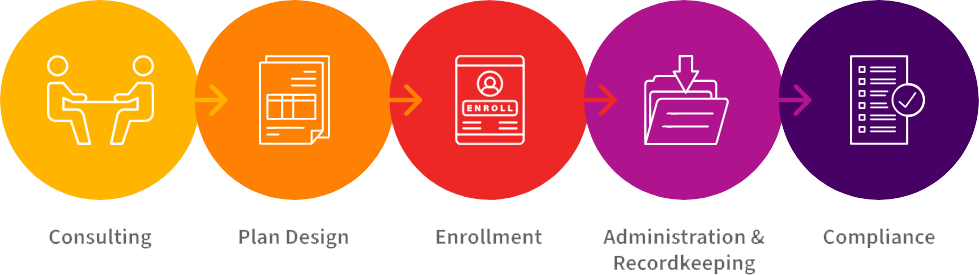

Our process covers all the services you need:

We’ll save you time and effort in choosing and offering your plan and, ensure it continues to operate as cost efficiently as possible.