RETIREMENT SOLUTIONS

Retirement Plans 101

Streamline retirement plans and empower your HR team.

Retirement plans are increasingly important for retaining and attracting talent. But their recordkeeping, administration and compliance landscape can be complex, time consuming and expensive. That’s why it’s imperative to partner with the right experts — so that they can handle all the retirement plan details while your stretched in-house HR team can focus on recruitment and retention.

Retirement plans can be confusing. That’s where Daybright comes in. We assist employers and sponsoring entities with retirement plan:

- Consulting, design and administration

- Investment advisory services

- Education, communications and enrollment

- Recordkeeping

- Third-party administration

- Defined benefit actuarial services

Types of retirement plans

- Defined benefit retirement plans vs. defined contribution retirement plans

- ERISA vs. Non-ERISA

Which is best?

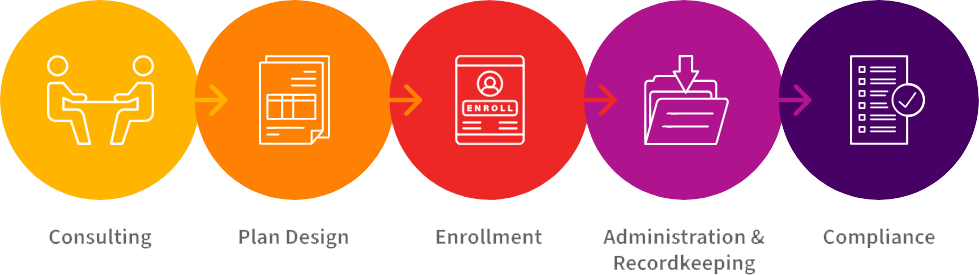

It depends. There are pros and cons to both approaches related to cost, flexibility, ease of sponsor oversight, coordination of providers, and customization of plans. Daybright can do both. Our process covers all the services you need:

We serve:

- Individuals

- Public sector employers

- Private sector employers

- Non-profit employers

- Financial advisors

- Other Third-Party Administrators (TPAs)